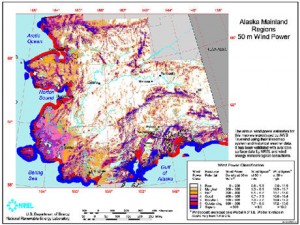

Agree with it or not, Sarah Palin’s hymn to the oil industry, “drill baby drill” was one of the 2009 election’s catchiest mantras. Surprising to find, then, that Palin is a fan of renewable energy, according to a recent New York Times report. Furthermore, Alaska, the second-largest oil producing state after Texas, is fertile ground for renewable energy. Fuel prices there are high. Strong winds support a growing wind power industry. Palin wants 50 percent of the state’s electricity to come from hydro power by 2025.

This doesn’t actually jibe with Alaska’s image as the oil and gas industry’s treasured love child, but there’s more to this story than irony. It speaks to why renewable energy’s time might actually have arrived. For real, this time, and not like the giant renewable energy head fake of the 1970s.

This doesn’t actually jibe with Alaska’s image as the oil and gas industry’s treasured love child, but there’s more to this story than irony. It speaks to why renewable energy’s time might actually have arrived. For real, this time, and not like the giant renewable energy head fake of the 1970s.

That was the era when the Gulf oil states started flicking the spigot on and off according to how many tricked out 747s the Saudi royal family needed, or how mad they were at Washington over U.S. Middle East policy. Gas efficient cars went mainstream. The first roof-mounted solar arrays appeared. Utilities invested in fuel cell development. Jimmy Carter put solar panels on the White House roof. Schools and other public buildings were designed using passive solar heating and cooling techniques. Then the price of sweet crude dropped into the cellar, Ronald Reagan ripped out the White House solar panels, and the renewable energy industry turned back into a hippie pipe dream.

So renewable energy is hot again, but why won’t it suffer the same fate it did when bell bottoms were in style? After all, we live in a market economy. No matter how good an idea renewable energy is, the market still favors fossil fuels. When the price of oil falls, the power that renewable energy sources produce is too expensive to compete.

The difference between now and the ‘70s is that the oil’s cost dynamics are changing permanently. China, India, and a host of developing economies are competing with the U.S. in international oil markets. Barring a complete collapse of those countries’ industrialization programs, that competition will keep oil prices at steadily higher levels. Also, the era of cheaply extracted oil is waning. An increasingly large percentage of oil reserves are hard to get out of the ground, and the prices will reflect the greater effort and new technology to bring it to market.

The difference between now and the ‘70s is that the oil’s cost dynamics are changing permanently. China, India, and a host of developing economies are competing with the U.S. in international oil markets. Barring a complete collapse of those countries’ industrialization programs, that competition will keep oil prices at steadily higher levels. Also, the era of cheaply extracted oil is waning. An increasingly large percentage of oil reserves are hard to get out of the ground, and the prices will reflect the greater effort and new technology to bring it to market.

Rural Alaska is a laboratory for this dynamic. Market forces, acting through the price of shipping and the per-gallon price of the fuel, conspire to make fuel-generated electricity outrageously expensive in rural Alaska – five to ten times higher than in the lower 48. If the price of oil were lower, the market might be able to absorb the high delivery costs. But the price isn’t low enough, and here’s betting that it never will be. That means the local market conditions in rural Alaska will permanently favor renewables. “Despite high installation costs and the need for cold-weather engineering,” the Times reported, “wind turbines can often produce power at a lower cost than diesel generators by eliminating the need for fuel.”

How long before the base price of oil rises enough to make wind and solar the economic choice in rural Wyoming, the Dakotas, Texas, California, etc.? A long time off, maybe. But the fact that it is already happening in Alaska is not an isolated fluke. It’s the first sign that the economic case for renewable energy is growing strong enough to endure the next temporary decline in oil prices.