Pro- and anti-nuclear activists hit each other with everything short of chains and broken bottles during construction of the Seabrook Station nuclear power plant back in the mid-’70s. The Clamshell Alliance opposition group occupied the construction site and waged a nonstop PR campaign against Seabrook right up to 1986, when the beleaguered plant finally went online. The consortium that built the plant countered with its own multimedia PR campaign, including one television spot featuring a woman who owned a backyard hydroelectric plant. The ad sticks in my mind because almost 30 years later, it raises a relevant issue in renewable energy and how to make it work best.

The ad depicted the hydro plant owner, an elderly woman wearing a trench coat with a scarf around her neck, standing in front of her hydro plant, which looked like a tool shed perched over a brook near her home. She was one of those redoubtable New England doyennes you see making long, detailed comments at town meetings and staffing the coffee pots at church suppers. Her message, delivered in clipped, no-nonsense Yankee diction, was that New England needed every energy source it could get, and not just “my little hydro plant” but Seabrook Station too.

The ad depicted the hydro plant owner, an elderly woman wearing a trench coat with a scarf around her neck, standing in front of her hydro plant, which looked like a tool shed perched over a brook near her home. She was one of those redoubtable New England doyennes you see making long, detailed comments at town meetings and staffing the coffee pots at church suppers. Her message, delivered in clipped, no-nonsense Yankee diction, was that New England needed every energy source it could get, and not just “my little hydro plant” but Seabrook Station too.

I doubt I would have contradicted this formidable grande dame in person, but I wasn’t completely buying what she said. Why does electricity have to be created in huge, centralized power plants? The idea of getting my electricity from a network of neighborhood and backyard power sources tickled my imagination. Given a choice of buying my wattage from a nuclear plant perched upwind from the most heavily populated region in the U.S., or buying the same wattage from the nice old lady down the street, I’ll take “B” any day. Or maybe I could plug into the dairy farm two towns over that uses cow manure to power a small-scale methane plant, or the school bus company that put two wind turbines in their parking lot.

It seems odd to think of energy as a mom-and-pop industry like your local corner store, but with the way renewable technologies are developing, it’s not that far fetched. Think of it for a minute. How often can you read the news and NOT happen upon another idea for generating electricity, ranging from the familiar to the exotic? Energy from the sun, energy from the wind, energy from waves, energy from tides. Energy from garbage, energy from cow poop, energy from holes in the ground. Energy from waste water broken down into hydrogen atoms. Energy from fusing atoms together. Energy from weeds and algae. They all have the potential to make generating power as much a local business as the post office and the hardware store.

Consider concentrated solar photovoltaic (CPV) technology as an example. CPV modules pack more generating capacity into a smaller footprint than conventional solar photovoltaic (PV) modules. That means property that might not have produced economically practical amounts of electricity with PV modules now can. Picture your local storage space company, with all those acres of flat roofs. The owner makes most of his/her money on fees, but what if putting CPV modules on the roof turned into a profitable side business?

There’s an electrical production and distribution model called wholesale distributed generation (WDC) that’s gaining favor among renewable power advocates. WDC replaces large, remote power plants attached to the grid through long-distance transmission lines with smaller facilities hooked directly into local grids. It saves the land and cost of building new transmission lines to connect large facilities to local grids. The smaller facilities that thrive in WDC infrastructures will also require less permitting and face fewer regulatory obstacles. It’s a natural fit for local renewable energy sources, and a long-term sustainable power production model.

Allowing that renewable technologies were too immature 30 years ago to sustain the economy, I’ll concede the point made by the lady in the Seabrook commercial. Back then, facilities like her little hydro plant couldn’t carry the load, and realistically they still can’t today. In a few years though, don’t be surprised if you go to your local farmer’s market to shop for fresh local voltage along with fresh local produce. Technology writer Alex Steffen of Worldchanging.com predicted this movement four years ago, and his vision seems to be playing out.

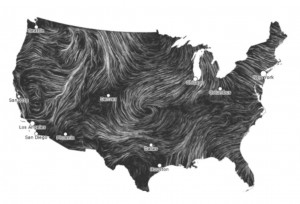

“I think the things that would really blow us away if we could jump forward 20 years would not be the giant fields of windmills, but the 1,000 changes in daily life that have taken place in order to save energy,” he said in a Forbes interview. Power sources, he predicted, will move closer to home. “I think we’re going to see a lot more local energy, especially in places that are gifted with lots of sunshine, or wind, or strong rivers. As houses and small communities produce their own energy, it will flow back and forth on ‘smart infrastructure’ two-way power grids that deliver from as well as to the home.”

Iran is caught in a similar rock-and-a-hard-place

Iran is caught in a similar rock-and-a-hard-place